All the sessions from Transform 2021 are offered on-demand now. Watch now.

The pandemic spurred investments in AI across practically just about every business. That’s according to CB Insights’ AI in the Numbers Q2 2021 report, which discovered that AI startups attracted record funding — more than $20 billion — in spite of a drop in deal volume.

While the adoption price varies among organizations, a majority of them — 95% in a current S&P Global report — take into account AI to be critical in their digital transformation efforts. Organizations had been anticipated to invest more than $50 billion in AI systems globally in 2020, according to IDC, up from $37.5 billion in 2019. And by 2024, investment is anticipated to attain $110 billion.

The U.S. led as an AI hub in Q2, according to CB Insights, attracting 41% of AI startup venture equity offers. U.S.-based firms accounted for 41% of offers in the prior quarter, up 39% year-more than-year. Meanwhile, China remained second to the U.S., with an uptick of 17% quarter-more than-quarter.

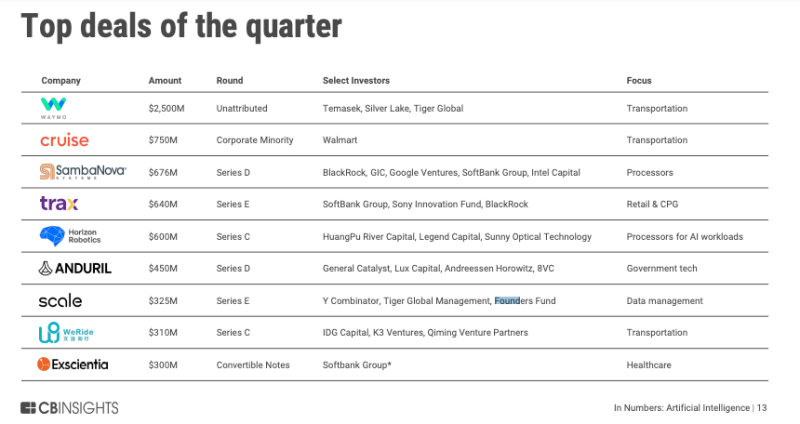

AI startup funding in Q2 was driven mainly by “mega-rounds,” or offers worth $one hundred million or more. A total of 24 firms reached $1 billion “unicorn” valuations for the initial time, and AI exits enhanced 125% from the previous quarter, whilst AI initial public offerings (IPO) reached an all-time quarterly higher of 11.

Unicorn valuations

Cybersecurity and processor firms led the wave of newly minted unicorns, with finance and insurance coverage and retail and customer packaged goods following close behind. On the other hand, wellness care AI continued to have the biggest deal share, accounting for 17% of all AI offers in Q2.

Overall mid-stage deal share — i.e., series B and series C — reached an all-time higher of 26% for the duration of Q2, whilst late-stage deal share — series D and beyond — remained tied with its Q1 2021 record of 9%. But the news wasn’t all positive. CB Insights discovered that seed, angel, and series A offers took a downward trend, creating up only 55% of Q2 offers, with corporate venture backing leveling out. Just 39% of all offers for AI startups integrated participation from a corporate or corporate venture capital investor, up slightly from 31% in Q1 2021.

But CB Insights says that the rise in AI startup exits in Q2 reflects the strength of the sector. “The decline of early-stage deals and increase of mid- and late-stage deals hint at a maturing market — however, early-stage rounds still represent the majority of AI deals,” analysts at the firm wrote. “Plateauing [corporate] participation in AI deals may reflect a stronger focus on internal R&D or corporations choosing to develop relationships with AI portfolio companies instead of sourcing new deals.”

Experts predict that the AI and machine understanding technologies marketplace will attain $191 billion by the year 2025, a jump from the roughly $40 billion it is valued at presently. In a current survey, Appen discovered that firms enhanced investments by 4.6% on typical in 2020, with a strategy to invest 8.3% per year more than the next 3 years.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25547838/YAKZA_3840_2160_A_Elogo.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25547226/1242875577.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546751/ES601_WEBR_GalleryImages_KitchenCounterLineUp_2048x2048.jpg)