A new GamesBeat occasion is about the corner! Learn more about what comes next.

The future appears vibrant in mobile games, but it is a fuzzy vibrant. And it is not just customer behavior in the course of the pandemic that is generating that uncertainty.

Mobile game makers came into 2021 in the midst of the pandemic with a lot of uncertainties about how the mobile ecosystem was altering. While we have some clarity on significant uncertainties — such as Apple’s privacy push and the antitrust litigation more than the App Store in between Epic Games and Apple — there’s nevertheless a lot of debate about how items will turn out for each iOS gaming and the broader mobile markets.

I’ll be discussing these uncertainties and modifications at events coming this week and quickly immediately after. On September 29 at 10 a.m. Pacific time, I’ll moderate a panel on what’s next with mobile app ad monetization. The panelists consist of MoPub’s worldwide industrial head Robin Wheeler, Facebook Audience Network’s worldwide lead Steve Webb, and Vungle’s senior vice president of worldwide income Scott Silverman.

And I’m moderating a panel on mobile game monetization trends for 2021 at the Mobile Growth Association’s MGS Games 21 occasion at 10:20 am Pacific on September 30 with Chris Akhavan, vice president at EA Mobile Jarkko Rajamaki, vice president of advertisements at Rovio and Carissa Gonzalez of Pixelberry Studios. (The MGS Games 21 occasion will be hybrid, each on-line and in-individual at the SF Jazz Center in San Francisco). We’ll also be discussing these subjects at our upcoming GamesBeat Summit Next occasion on November 9-10 and our upcoming GamesBeat occasion on January 25 to 27, 2022.

Webinar

Three prime investment pros open up about what it requires to get your video game funded.

Watch On Demand

I’ve also performed some interviews this summer season with other mobile gaming voices such as Offer Yehudai, president of Fyber, and Brian Bowman of Consumer Acquisition other individuals about this topic. The distinctive professionals across the mobile gaming ecosystem are coming about to stronger opinions about what the future holds, and we’ll see a lot of that suggestions coming via the events in the coming days.

Growth predictions

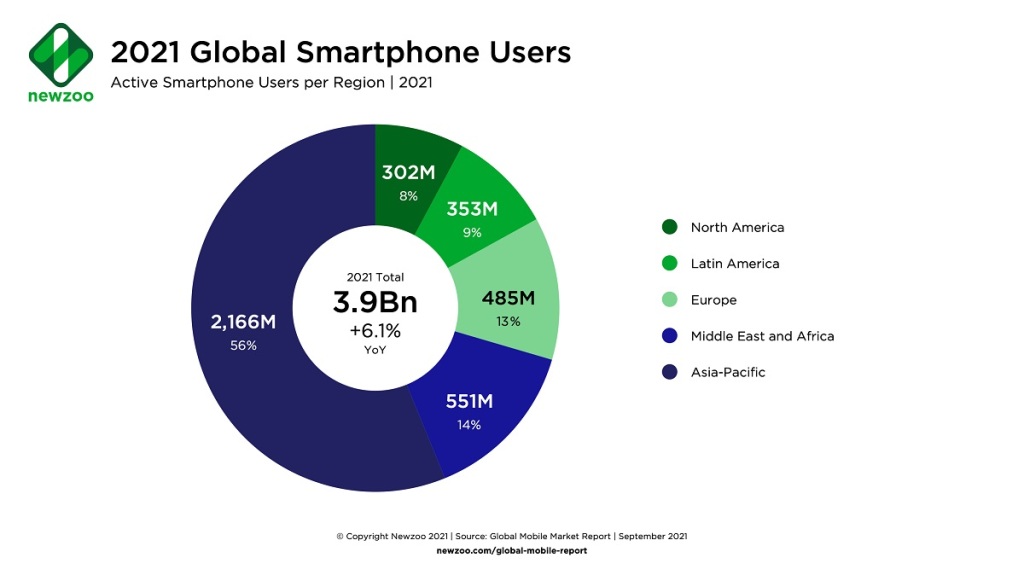

Image Credit: Newzoo

Newzoo predicted last week that mobile gaming revenues would develop 4.4% to $90.7 billion in 2021, coming off of 27% income development in 2020. The 2021 development is slower than the all round 11% compound annual development price anticipated from 2019 to 2024 for the reason that it is so difficult to beat last year’s extraordinary income as men and women played more mobile games at the onset of the pandemic.

Because of Apple’s focus on privacy more than targeted advertisements and the accompanying regulatory policies about the world, it has grow to be more difficult to target mobile gamers with functionality-based marketing, exactly where advertisers get paid if customers take action based on advertisements. It’s no longer straightforward to measure if distinct advertisements are powerful in that respect.

Dave Westin, chair of the advisory board and strategic speaker outreach for MGS Games, mentioned in an interview with GamesBeat that these headwinds will combine with tailwinds such as the expansion of gaming into new territories like the Middle East, Africa, Latin America, India, and emerging components of Asia.

“You’re going to see some consolidation among the vendors, and from a publisher perspective, we’re seeing a lot of growth in international markets,” Westin mentioned.

Newzoo expects the quantity of smartphone customers to attain 3.9 billion in 2021, up 6.1%, with a lot of the development in emerging territories.

But a lot of these predictions are based on assumptions about how each iOS and Android will transform in coming months. Facebook released a report in July that discussed many qualitative elements that could impact mobile gaming and the wider ad ecosystem.

While the IDFA transform place stress on revenues, eMarketer noted a positive — time spent on mobile games improved by 9 minutes per day per U.S. adult in 2021, and most of these games will hold onto that development going into 2022.

Market researcher IDC estimates that mobile game income is $156 billion, and about $26.8 billion of that — or 17.2% — is ad income. This imbalance suggests an chance to improve ad income, Facebook mentioned. Omdia predicts in-app ad income will rise 21.3% in 2021.

This will transform as the market tends to make a transition from the older, historical-based waterfall format for marketing to a new format dubbed true-time app bidding. With app bidding, there are open, true-time auctions in between ad networks and other demand sources — enabling more competitors amongst ad purchasers, exactly where the highest bidder wins. This final results in more income going to publishers and developers for every single ad impression served to players in their mobile games.

Apple’s post-IDFA ecosystem

Image Credit: Tenjin

Of the $90.7 billion in income in 2021, Newzoo mentioned $41.1 billion will come from the iOS platform (45.3% of the worldwide quantity).

Mobile game businesses have been forced to shift their approaches amid the altering industry due to tightening privacy measures across the board such as Apple’s modifications to use of information from the Identifier for Advertisers (IDFA).

“IDFA has been in play for almost a year, either in discussions or the execution, and it’s still something that we’re going to be talking about a lot,” Westin mentioned.

Newzoo believes that 85% of iOS customers updated to iOS 14.5, which Apple launched in April. And most customers are not opting in to be tracked for marketing purposes, which means the information previously collected by way of IDFA will no longer be accessible to advertisers for tracking the effectiveness of advertisements. According to Fyber, opt-in prices for ATT have been just 17% globally as of mid-September. Those prices are worse than they have been early on this spring.

Fyber’s Yehudai mentioned that the App Tracking Transparency (ATT) policies which encompass the IDFA transform have the prospective to hurt in-app obtain income, which accounts for the bulk of all round app and game revenues and is generally enabled by the cautious person targeting of customers with advertisements that is a lot tougher to do now.

Citing similarly low September information from Flurry, worldwide customers becoming shown the opt-in prompt have been opting in at a price of only 23% week-more than-week considering that August, Bowman at Consumer Acquisition mentioned.

“In the U.S., the opt-in rate is an abysmal 16%. With these low ATT consent rates, custom and lookalike audience size has been reduced 77% worldwide (86% in the U.S.),” Bowman mentioned. “As a result, effectiveness has dropped. Many mobile app developers have paused spending on iOS or shifted heavily to Android, inflating costs per mille (CPMs), [a measure of ad rates].”

Yehudai of Fyber believes that hypercasual game players are opting out at higher prices above 80%. As these advertisements are much less powerful, the ad prices paid by game businesses dropped for a time but then recovered.

“The flywheel kept going for hypercasual games,” Yehudai mentioned. “I think it’s good news for the industry. Hypercasual has been resilient.”

Social casino games, which rely on precise targeting of customers to uncover the significant spenders, are getting a tougher time. That could imply these game advertisers will invest much less, and that ad prices will drop in that segment, and sector revenues could fall as effectively. They are attempting to invest in advertisements that target wider audiences but for more affordable rates.

“It’s getting harder for them to find those users,” Yehudai mentioned.

Image Credit: Consumer Acquisition

Yehudai also noted development in Android revenues as a outcome of the IDFA modifications, as Google hasn’t implemented the identical strict privacy modifications and game makers are shifting budgets to Google as a outcome.

“All of a sudden, companies are seeing the same and even more revenue on Android. And that’s a change from what it used to be,” Yehudai mentioned. “Android is closing the gap.”

Despite this transform, Yehudai is doubtful that Apple is thinking about rolling its IDFA modifications back, as some developers hope.

Bowman of Consumer Acquisition mentioned in a weblog post that the transition to iOS 15 that is taking place now highlights more anti-competitive behavior, as Apple is utilizing “privacy scare tactics” to get customers to opt-out of providing information to developers and third-party ad platforms though utilizing friendlier language when it comes to asking if Apple’s personal apps can use that information.

“Ultimately, this behavior is highly disruptive to the vitality of the iOS advertising market,” Bowman mentioned. “It is having a negative impact on mobile app game developers, advertisers, and consumers.”

Tianyi Gu, a Newzoo analyst, mentioned in an e-mail to GamesBeat that Newzoo does not think the IDFA modifications will hurt the game market as a lot as feared, but other individuals think that pockets such as technique game makers will have a difficult time.

Content fortresses

Image Credit: Newzoo

To retain some of the tracking capacity they had, mobile businesses are turning into content fortresses, and businesses — such as Apple itself — are doubling down on internal ad networks, Gu mentioned. Gu believes businesses are turning themselves into “content fortresses,” referring to proprietary ad tech systems that publishers use to cross-market games inside their personal content portfolio.

“In other words, publishers are building in-house ad tech to leverage first-party data and promote new games within the content portfolio,” Gu mentioned. “In this way, publishers can keep users within their ecosystem while complying with Apple and Google’s new rules.”

In the West, businesses such as Zynga, AppLovin, and Facebook are allocating sources to strengthen their content fortresses, mostly by way of merger and acquisition (M&A) activity. Tencent and ByteDance are utilizing the identical tactic in the East (and globally), Gu mentioned.

“I think big data is going to come into play, being able to take data through data exchanges or data marts and appending that to a unique identifier and then being able to build behavioral targeting,” Westin mentioned. “That is what I see is really the next big thing coming in the space. People realize they’re going to have to figure out ways to properly target these campaigns. And if they don’t have that, that internal data themselves, they’re realizing that there are other companies out there that that do, and they’re taking advantage of that.”

Mobile game developers have been currently adopting hybrid monetization and IP-based-game approaches, and mobile privacy modifications are only accelerating these shifts, Newzoo mentioned.

Epic v. Apple fallout

Image Credit: Epic Games

Epic launched a higher-stakes battle, utilizing its powerful position with Fortnite in the games industry and suing Apple and Google for alleged monopolistic behavior.

But a federal judge, Yvonne Gonzalez Rogers in Oakland, California, handed Epic a significant defeat, in the end ruling in Apple’s favor on nine-out-of-ten counts, penalizing Apple (by way of an injunction) for its anti-steering App Store policies for in-app purchases.

These anti-steering policies, which Google also lately implemented, prohibit app sellers from marketing alternate payment systems outdoors the platform holder’s ecosystem. The judge identified that Apple’s anti-steering policy hurt customers by denying them techniques to uncover out about reduce rates for in-game things.

Newzoo expects developers will be permitted to charge much less in external payment selections for in-app purchases in the United States if Apple does not appeal to the injunction.

Newzoo believes that developers would not will need to spend Apple’s 30% reduce in this situation, providing the developers the fuller share of revenues (if they have external payment selections in location). Based on my personal reading of the Epic v. Apple verdict, I do not feel this is clear however, as the judge ruled that Apple has the correct to monetize its intellectual house.

Apple will have to permit developers to promote much better bargains and reduce rates if they go off the App Store to invest in their digital things. But Apple does not have to allow customers to make these purchases straight via option payment providers inside the App Store, as the judge ruled the “payment systems” monopoly, as Epic alleged, did not hold up. That was a significant aspect of the case that Epic lost. All Apple has to do is let developers inform customers about discounts elsewhere and hyperlink to these discounts.

Even if customers go off the shop to take benefit of these discounted gives, there is nothing at all stopping Apple from demanding a 30% reduce of these sales, although it would be tougher to gather, mentioned Richard Hoeg of Hoeg Law in an interview with GamesBeat.

Nevertheless, payment providers such as Xsolla and Paymentwall welcomed the selection for the reason that it will allow developers to gather emails from customers more simply and market their personal off-App-Store options in techniques that will advantage their brands and allow them to grow to be closer to their personal customers.

I think one of the largest challenges is friction, as it would be far more easy for option payment providers and mobile game devs to allow option payments straight inside the App Store. But the judge didn’t grant this victory to game developers, regardless of her discovering that Apple had engaged in anti-competitive practices.

Future development

Image Credit: Immutable

In 2022 and beyond, Facebook believes mobile cloud gaming will catch on with formats such as Instant Games on the Facebook platform. These use cloud datacenters to allow no-download, low-friction games men and women can appreciate instantaneously. These have generally utilized HTML5 as a format in the previous, but the many kinds of cloud gaming should really allow players to appreciate deeper and more graphically wealthy games instantaneously, Facebook mentioned.

As for items like blockchain games or nonfungible tokens (NFTs) coming to the rescue, game startups and significant organization acquisitions have had a large flurry of activity this year. But we’ll see if these outcome in mainstream adoption.

The industry for NFTs surged to new highs in the second quarter of 2021, with $2.5 billion in sales in the very first half of the year, up from just $13.7 million in the very first half of 2020. NFTs have exploded in other applications such as art, sports collectibles, and music. NBA Top Shot (a digital take on collectible basketball cards) is one instance. Published by Dapper Labs, NBA Top Shot has surpassed $780 million in sales in just a year. And a lot of are banking that gaming will be a significant beneficiary.

Westin believes that we’re nevertheless some time, possibly a year, from seeing a large influence in the mobile gaming organization.

“There isn’t a critical mass of publishers putting out that type of game,” Westin mentioned. “In the meantime, we are seeing a lot of activity in hypercasual, social casino, and real-money (gambling) gaming. Those are the areas that we see having upticks.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25386604/STK471_Government_Surveillance_CVirginia_B.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25385148/Mario_Kart_8_Deluxe_Booster_Course_Pass.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25409131/target_exterior_design.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25408886/post_logo.png)