Where does your enterprise stand on the AI adoption curve? Take our AI survey to locate out.

Mobile gaming downloads had been flat in the initially quarter ended March 31 compared to a year ago, although mobile game revenues averaged about $1.7 billion a week, up 13% from $1.5 billion a week in the identical quarter a year ago, according to a report by mobile information and analytics firm App Annie.

That suggests that it was tougher for mobile game corporations to beat last year’s numbers simply because of a one-time pandemic boom. But the numbers are encouraging simply because they show that gaming held onto its gains even as other types of entertainment began coming back in the second quarter as pandemic circumstances eased. (App Annie mentioned its numbers could transform as it finalizes finish-of-month information).

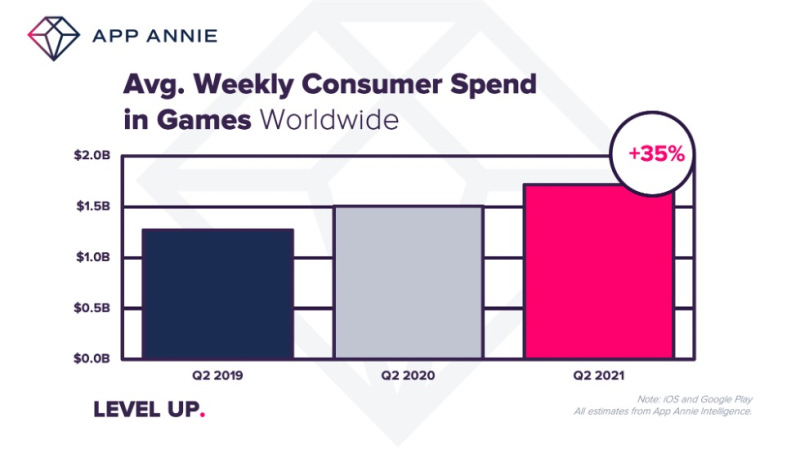

App Annie mentioned the game marketplace had a billion downloads a week in the second quarter, which was about the identical as it has been for the fifth straight quarter. This is flat compared to the initially quarter of 2020, but up 15% from the typical for 2019. The $1.7 billion in revenues per week in the second quarter was up 3% from the initially quarter of 2021, and it was up 35% from the second quarter of 2019.

In the initially quarter ended March 31 this year, the development price for games was a lot stronger. The Q1 report mentioned buyers spent $1.7 billion per week on mobile games, up 40% from pre-pandemic levels, although mobile game downloads grew 30%.

App Annie didn’t clarify the slowdown in the second quarter for games, but it does coincide with Apple’s prioritization of privacy more than targeted marketing with the April launch of iOS 14.5. That version asks customers if they will grant permission for advertisers to use their information from the Identifier of Advertisers (IDFA) for marketing purposes. Most customers are not anticipated to grant that permission, and that could hurt the potential of the game business to target advertisements at gamers.

While some of this slowdown could spook investors, the numbers are not so poor for games. Games stay the greatest driver of development in app retailer customer commit, largely by means of in-app purchases. Entertainment apps had been the second-biggest driver of development in customer commit in the second quarter.

The game charts

In terms of downloads, there had been 3 outstanding titles. Supersonic’s Bridge Race topped the chart, although Hair Challenge was at No. 2. The latter is one more female-oriented game pretty related to the title in fifth spot, High Heels. It’s also worth mentioning Good Job’s Paper Fold, which leaped 12,385 areas to No. 8.

There is constantly much less movement in the games commit chart, exactly where the hit titles have considerably longer lives and more devoted players. The Q2 2021 chart was headed once more by Roblox, but the outstanding performer was Uma Musume Pretty Derby at No. 2. This is a Japanese game based on a Television series. It rose 24 areas in the quarter.

Manga also inspired two of the quarter’s breakout games: Ni no Kuni: Cross Worlds and One Piece Fighting Path. Japan is a powerhouse gaming marketplace, and the mobile marketplace general — and is a essential marketplace to look at in a robust mobile tactic, App Annie mentioned.

Overall apps preserve expanding

Image Credit: App Annie

Meanwhile, quarterly spending on apps hit $34 billion in the second quarter, up 14.2% from $27 billion in the second quarter of 2020. App Annie mentioned that meant that buyers retained the app habit they picked up for the duration of the pandemic regardless of the easing of lockdowns. That figure was a quarterly record for the general app business. The $34 billion figure for Q1 2021 was up 6% from $32 billion in Q1 2021.

By platform, the App Annie numbers reveal that commit on the Apple App Store in Q1 2021 grew 30% year more than year to $22 billion, although commit on Google Play leaped 20% to about $12 billion.

App Annie mentioned that the numbers prove once more the enduring wellness of the app economy. Thirteen years ago, Apple launched its App Store in

2008 with just 500 titles. There are now 5.5 million across iOS and Android.

“Observers keep waiting for the quarterly revenue numbers to decline. They never do,” App Annie mentioned. “Despite predictions of app fatigue, the market is still booming.”

The information also suggests that the widespread bump in-app spending prompted by the international pandemic remains in spot regardless of the easing of lockdowns. Stay at home orders absolutely pushed buyers towards mobile-based entertainment and productivity across 2020. Yet, as of mid-2021, there is no sign of this habit declining.

App spending on the rise

Globally, the app business is getting into a more mature mobile marketplace. Downloads stay elevated, but the genuine development is seen in usage and customer commit, App Annie mentioned. The information shows that Google Play downloads remained steady year more than year at 25 billion, although iOS downloads contributed 8 billion for the quarter.

It’s organic for downloads in mature mobile markets to start stabilizing as several buyers currently have apps downloaded on their phones. They do not cease downloading apps, but the development slows as the genuine focus is on usage. Growth in customer commit indicates that buyers have come to be more comfy spending cash on subscriptions and in-app purchases.

HBO Max development shows demand for video streaming

Image Credit: App Annie

The prime apps in Q2 2021 comprised the anticipated mix of social, messaging, and video streaming solutions. TikTok sustained its outstanding dominance in the app space. It is number one in terms of each downloads and customer commit.

The Wall Street Journal reported that ByteDance (owner of TikTok) had reported income for 2020 at $34.3 billion. That’s 111% greater than the figure for 2019.

In Q2, HBO Max hit No. 6 on the prime charts, up six spots from the prior quarter. Since the achievement of Netflix, key content producers have rushed to launch their personal subscription-based streaming solutions. HBO/Warner entered the marketplace with HBO Max in May 2020, a relaunch of the original HBO Now app.

The enterprise ended March 2021 with 44.2 million domestic subscribers and 63.9 million worldwide subscribers (it does not break out the totals for the current HBO cable buyers and Max subscribers). And the service received a enormous increase in May when it aired the Friends Reunion. It was reported that the Television unique drove more sign-ups to Max in its opening weekend in the US than any of Warner Bros.’ new films so far this year.

Another notable presence in the Q2 2021 Top Apps chart (by customer commit) is Piccoma. The webtoon comic app run by Kakao Japan (the Japanese subsidiary of South Korea’s Kakao) continued its steady rise to come to be the world’s seventh-greatest app by income. Piccoma has changed the way Japanese buyers spend for comics by turning comprehensive books into episodes and providing a freemium company model in which readers can spend rather than wait for the next installment. The enterprise confirmed revenues of 37.6 billion yen ($340 million) in 2020 and claims 4.2 million each day customers.

Privacy and Short-kind video dominate the Q2 breakout apps

In any quarter there are a quantity of solutions that come from nowhere to announce their presence in the app shops. In Q2 2021, the charts reveal the lengthy shadow cast by TikTok. The app itself is at No. 2. However, the Tiki app hit No. 5, and in India, the brief video app Roposo was one of the prime breakout social apps by downloads. That came in the wake of India’s ban of TikTok more than tensions with China. Lots of VPN apps, which shield a user’s privacy, had been also in the prime ranks.

Overall marketplace recovery

Some of the general app numbers show which markets and sectors are recovering from the pandemic.

“As some markets begin opening back up, we’ve seen early indications of industries on the road to recovery,” App Annie mentioned. “We’ve also seen signals on what consumer behaviors are here to stay. We’ve taken a look at the mobile app categories experiencing the biggest growth in Q2 2021 by downloads, consumer spend and time spent — an indication of which apps are in demand, most used and most valued.”

Tools apps led download development globally, with VPN apps topping the breakout charts. This is additional validation of buyers prioritizing privacy — a key trend underpinning Apple’s most recent iOS 14.5 release. Sports and Medical apps also rank amongst the prime categories for downloads amidst demand for telehealth and mobile options to public wellness policies and access to pharmacies.

Business apps set new records for time spent as Zoom and Google Meet continue to prime the breakout charts. Booking.com was a international breakout app in Q2 2021 for time spent — an indication that buyers are hungry to travel. Cryptocurrency remains common with Binance

topping the time spent chart.

Road to recovery

Image Credit: App Annie

App Annie mentioned it sees signals that buyers are eager to hit the road and the skies. Monthly hours spent in travel and navigation apps are on an upward trend in markets like the US and the UK, exactly where vaccination rollout has picked up substantial traction. The marketplace has recovered from 2020’s low but has nonetheless but to attain pre-pandemic levels in 2019.

South Korea is the most sophisticated amongst the 3 markets, as time spent in travel and navigation apps in Q2 2021 has surpassed pre-pandemic levels, and proved more resilient than other nations with much less variance general.

Despite some markets opening up, other markets like Brazil and India are nonetheless actively going by means of new waves of COVID-19. Usage of travel apps in each nations has rebounded for the duration of Q1 and Q2 of 2021 compared to last year — a positive sign for future trends. However, Brazil, France, and India nonetheless stay on the road to recovery to pre-pandemic levels in 2019. France had seen a sturdy uptick more than summer time in 2020 and App Annie expects to see related levels return more than summer time 2021, specifically amidst vaccine rollouts. Engagement in travel and navigation apps can serve as a major indicator of ‘normalcy’ resuming in a marketplace, but this is closely tied to vaccine rollout and active waves of COVID-19, App Annie mentioned.

The Sports business is also producing a comeback. In Japan and Korea, time spent in April 2021 has rebounded from the fallout in 2020, and surpassed pre-pandemic levels in April 2019 by 20% and 10% respectively. The Olympics could bring in a substantial viewer base globally, although the UEFA Champions League and UEFA European Football Championship has helped bolster the European rebound, with time spent in Sports apps in April 2021 up 10%, 10%, 20%, and 55% year more than year in Germany, Spain, the United Kingdom, and Italy. In reality, UEFA 2020 Official was the

While the US has bounded back because April 2020, time spent in sports apps remains sturdy. The U.S. is on the road to recovery and poised to see interest in sports apps resume. The upcoming NFL season will probably drive viewership and engagement in fantasy football apps, App Annie mentioned.

Hybrid work, fitness, and meals delivery

Hybrid and work-from-home models are definitely the new norm. Time spent in company apps is nonetheless expanding as we head into the sixth quarter of working from home. Time spent is up quarter-more than-quarter even in markets with sturdy vaccine rollout like the US (+55% vs Q1 2021) and the United Kingdom (+15% vs Q1 2021). People are spending more time in company apps than ever ahead of — even compared to last year at the height of the pandemic. Even in markets like Australia and the U.S. — exactly where personnel are going back into the workplace — buyers are nonetheless applying company apps heavily to connect and collaborate although working remotely. Mobile connectivity is more critical than ever as personnel and enterprises embrace a hybrid, or even completely-remote, working model.

“At-home” fitness remains in higher demand globally — specifically these apps that focus on receiving buyers out and about, such as Strava, Kahoot, AllTrails, and MyFitessPal.

Connected devices like Peloton and Fitbit also make the prime breakout apps by customer commit. Weight Loss apps also saw breakout customer commit from Q1 2021 as buyers focus select mobile app subscriptions to handle their weight-loss plans.

Food and drink apps represent a comparatively exclusive vertical that has seen dramatic development in time spent because the start out of COVID-19 and is displaying no indicators of slowing in markets like the U.S. and United Kingdom. Ultimately, meals delivery, grocery delivery, and restaurant-based apps make people’s lives less complicated — developing a very simple, seamless expertise for receiving fresh make or restaurant-high quality meals. Recipe apps also make the prime charts for several markets as buyers select to get inventive in the kitchen, App Annie mentioned.

/cdn.vox-cdn.com/uploads/chorus_asset/file/11742007/acastro_1800724_1777_EU_0001.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24401977/STK071_ACastro_apple_0001.jpg)